Table of Contents

1. Introduction

Bitcoin, while dominant in market capitalization, suffers from limited programmability due to its restrictive scripting language. This paper addresses the challenge of enabling Turing-complete smart contracts for Bitcoin by leveraging the Internet Computer (IC) blockchain. The proposed architecture bypasses traditional, vulnerable bridging mechanisms, aiming to provide secure, efficient, and direct programmatic access to Bitcoin's value.

The core motivation stems from the inability of existing solutions—whether built atop Bitcoin or using bridges—to simultaneously achieve security, efficiency, and direct read/write capabilities. Bridge-related hacks, resulting in losses exceeding hundreds of millions, underscore the critical need for a trust-minimized approach.

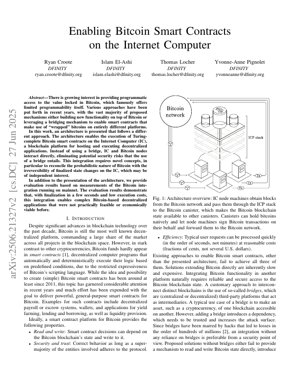

2. Architecture Overview

The architecture enables IC-based smart contracts (canisters) to interact natively with the Bitcoin network. IC node machines directly fetch Bitcoin blocks and pass them through the ICP protocol stack to a dedicated Bitcoin canister. This canister serves as a verifiable and reliable source of Bitcoin's blockchain state for other canisters on the IC.

Key Insight: Eliminating the Bridge Attack Surface

The most significant architectural decision is the elimination of any third-party bridge. Instead of relying on an intermediary to attest to Bitcoin's state, IC nodes become light clients or full nodes, sourcing data directly from the Bitcoin peer-to-peer network. This reduces the attack surface to the security assumptions of the underlying Bitcoin and IC networks themselves.

2.1. Direct Integration vs. Bridges

Traditional cross-chain bridges act as centralized or decentralized custodians or attestors. They introduce a new trust assumption and a single point of failure. The DFINITY approach internalizes this function: the IC protocol itself is responsible for validating and finalizing Bitcoin data. This aligns with the broader blockchain ethos of minimizing trusted components, a principle emphasized in foundational work on decentralized systems security.

2.2. Bitcoin Canister & State Management

A system canister on the IC, the Bitcoin canister, maintains a validated subset of the Bitcoin blockchain. Other canisters can query this canister to read Bitcoin state (e.g., transaction confirmations, UTXO sets). To write, a canister holding bitcoins can instruct IC node machines to sign and broadcast transactions on its behalf to the Bitcoin network, using threshold signature schemes for security.

3. Technical Details & Mathematical Framework

A primary technical challenge is reconciling Bitcoin's probabilistic finality with the IC's deterministic finality. The IC uses a consensus mechanism that provides fast finality. Integrating Bitcoin requires a model to handle chain reorganizations.

The system likely employs a confirmation depth parameter $k$. A Bitcoin transaction is considered "finalized" for the IC's purposes once it is buried under $k$ blocks. The probability of a reorg deeper than $k$ blocks is negligible and decreases exponentially with $k$. The security can be formalized as: $P_{\text{reorg}}(k) \approx \text{exp}(-\lambda k)$ where $\lambda$ is a parameter related to the honest mining power. The IC canister state updates are gated on this probabilistic guarantee, creating a hybrid finality model.

Threshold ECDSA signatures are used to allow a decentralized set of IC node machines to manage Bitcoin private keys on behalf of canisters. The signing power is distributed, requiring a threshold of nodes to collaborate to sign a transaction, preventing single points of compromise.

4. Experimental Results & Performance

The paper presents evaluation results from the system running on the IC mainnet.

Finalization Time

~2-3 seconds

For IC state finality after Bitcoin transaction confirmation.

Execution Cost

Fractions of a cent

Low cost for smart contract execution on IC.

Bitcoin Confirmation

~10 minutes + $k$

Subject to Bitcoin's block time plus safety depth.

Chart Description: A hypothetical performance chart would show two lines: 1) Latency from Bitcoin transaction broadcast to IC canister state update, plateauing after $k$ Bitcoin confirmations. 2) Cost per smart contract operation on the IC, remaining orders of magnitude lower than executing complex logic directly on Bitcoin via Layer 2 solutions.

The results demonstrate that complex decentralized applications (DeFi protocols, decentralized autonomous organizations managing Bitcoin treasury) become economically viable, as the high costs and slow speeds of on-Bitcoin execution or certain bridge-based solutions are avoided.

5. Comparative Analysis & Related Work

The paper positions itself against several categories:

- Bitcoin Layer 2 (e.g., Lightning, RGB): Offer faster/cheaper payments but limited smart contract complexity and often require active participation.

- Sidechains (e.g., Rootstock, Stacks): Introduce their own security models and consensus, often relying on federations or merged mining, creating different trust assumptions.

- Bridge-based Wrapping (e.g., wBTC on Ethereum): Require trusted custodians or complex multi-sig federations, centralizing risk and having been frequent attack targets.

- Other Direct Integrations: The paper claims superiority in providing a direct read/write mechanism without bridges, contrasting with approaches that may only allow one-way pegs or lack direct write capabilities.

6. Analysis Framework: Core Insight & Critique

7. Future Applications & Development Directions

Short-term Applications:

- Decentralized Bitcoin-backed Stablecoins: Native, algorithmically regulated stablecoins collateralized by Bitcoin held in IC canisters, without a central issuer.

- On-Chain Treasury Management: DAOs can programmatically manage Bitcoin treasuries with multi-sig rules, automated investments, or grants paid in BTC.

- Bitcoin-native DeFi: Lending protocols where Bitcoin is the primary collateral, and borrowing/lending rates are determined by on-chain logic.

Future Technical Directions:

- Light Client Efficiency: Optimizing the Bitcoin client within IC nodes to use super-light proofs like FlyClient to reduce bandwidth and storage overhead.

- Multi-Chain Integration: Extending the architecture template to integrate other chains with strong security models (e.g., Ethereum post-Merge), positioning the IC as a secure "hub" for cross-chain computation.

- Zero-Knowledge Proofs for Privacy: Integrating zk-SNARKs to allow private interactions with Bitcoin state (e.g., proving ownership of a UTXO without revealing which one).

- Time-Locked Contract Interactions: Leveraging Bitcoin's native script opcodes like `CLTV` and `CSV` from IC canisters to create sophisticated cross-chain timed agreements.

8. References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

- Zamyatin, A., et al. (2021). SoK: Communication Across Distributed Ledgers. Financial Cryptography and Data Security.

- Bonneau, J., et al. (2015). SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies. IEEE Symposium on Security and Privacy.

- International Association for Cryptologic Research (IACR). (2023). Advances in Threshold Cryptography - Eurocrypt Proceedings.

- Buterin, V. (2014). Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform.

- Lewis, G. (2022). The Bridge Hacking Epidemic: A Systemic Risk Analysis. Journal of Cybersecurity and Blockchain.

- DFINITY. (2024). The Internet Computer Protocol Suite Technical Overview. (Official Documentation).

Core Insight

DFINITY isn't just building a better bridge; they're attempting to absorb Bitcoin as a module into the IC's execution environment. The real innovation is treating Bitcoin's blockchain as a slow, secure data availability layer, while outsourcing all complex computation and state management to the IC. This flips the script: instead of making Bitcoin smarter, they're making a smart contract platform natively Bitcoin-aware. It's a pragmatic acknowledgment that Bitcoin's core value is its security and settlement guarantees, not its runtime.

Logical Flow

The logic is compelling but hinges on a critical trade-off: you exchange bridge risk for protocol complexity risk. The security model now depends on the correctness of the IC's Bitcoin integration code—a massive, novel, and unaudited component within the IC's consensus layer. A bug here could be catastrophic. While bridges are obvious targets, this integrated complexity is a subtler, systemic risk. The paper handwaves this by appealing to the IC's overall security, but as the DAO hack on Ethereum proved, smart contract platforms are not immune to logic flaws in their core applications.

Strengths & Flaws

Strengths: The elimination of external bridges is a monumental security win. The performance metrics (speed, cost) are genuinely impressive for the use case and demolish the economic argument for on-chain Bitcoin contracts. It enables a new design space for DeFi on Bitcoin's liquidity.

Flaws: The architecture inherits Bitcoin's latency for final settlement. A 10-minute (+ confirmation depth) wait for true finality is anathema to real-time DeFi. It also creates a liveness dependency on the IC. If the IC halts, so does access to your integrated Bitcoin. This is a form of vendor lock-in more profound than a bridge. Furthermore, the reliance on threshold ECDSA, while advanced, adds cryptographic complexity whose long-term security is still being scrutinized by the academic community, as noted in recent publications from the International Association for Cryptologic Research (IACR).

Actionable Insights

For developers: This is a greenfield. Start building complex Bitcoin DeFi (lending, options, yield strategies) that were previously impossible. Focus on applications where the ~10-minute settlement lag is acceptable (e.g., treasury management, scheduled payroll).

For investors & protocols: Treat this as a high-potential, high-experimental bet. Diversify across multiple Bitcoin access strategies. The "no bridge" narrative is powerful for security marketing, but conduct deep technical due diligence on the IC's Bitcoin client implementation.

For researchers: The hybrid finality model is ripe for formal analysis. Develop frameworks to quantify the exact security loss when coupling a probabilistic chain (Bitcoin) with a deterministic one (IC). This work could benefit from applying rigorous composability frameworks used in analyzing other blockchain interoperability solutions.